Over the week, one post has gone viral on Facebook and Twitter. A Malaysian did a comparison to demonstrate how an average person’s purchasing power is shrinking drastically over 40 years.

He pointed out that the cost of living has gone up way more than the increment of salary.

In the 1980s:

Salary: RM1,500

One-storey terrace house: RM 25,000

Honda Civic: RM13,000

McD Double Cheeseburger: RM2.95

In 2020:

Salary: RM3,000 (↑ 2 times)

One-storey terrace house: RM 280,000 (↑ 11 times)

Honda Civic: RM108,000 (↑ 8.3 times)

McD Double Cheeseburger: RM9.45 (↑ 3.2 times)

As a financial planner, I agree that the cost of living has been increasing due to inflation.

However, what caught my attention wasn’t the calculation but one of the sentences in his post: “Kata orang, ukur baju di badan sendiri”.

“Ukur baju di badan sendiri – Maksud: Berbuat sesuatu atau bertindak atau berbelanja mengikut kemampuan diri sendiri.”

It means to undertake only what you have the money or ability to do and no more.

This phrase makes me think a litter deeper:

As a Generasi Muda, are we really doomed?

Are we really at the mercy of inflation?

Are we really the ‘Yang Tertekan’?

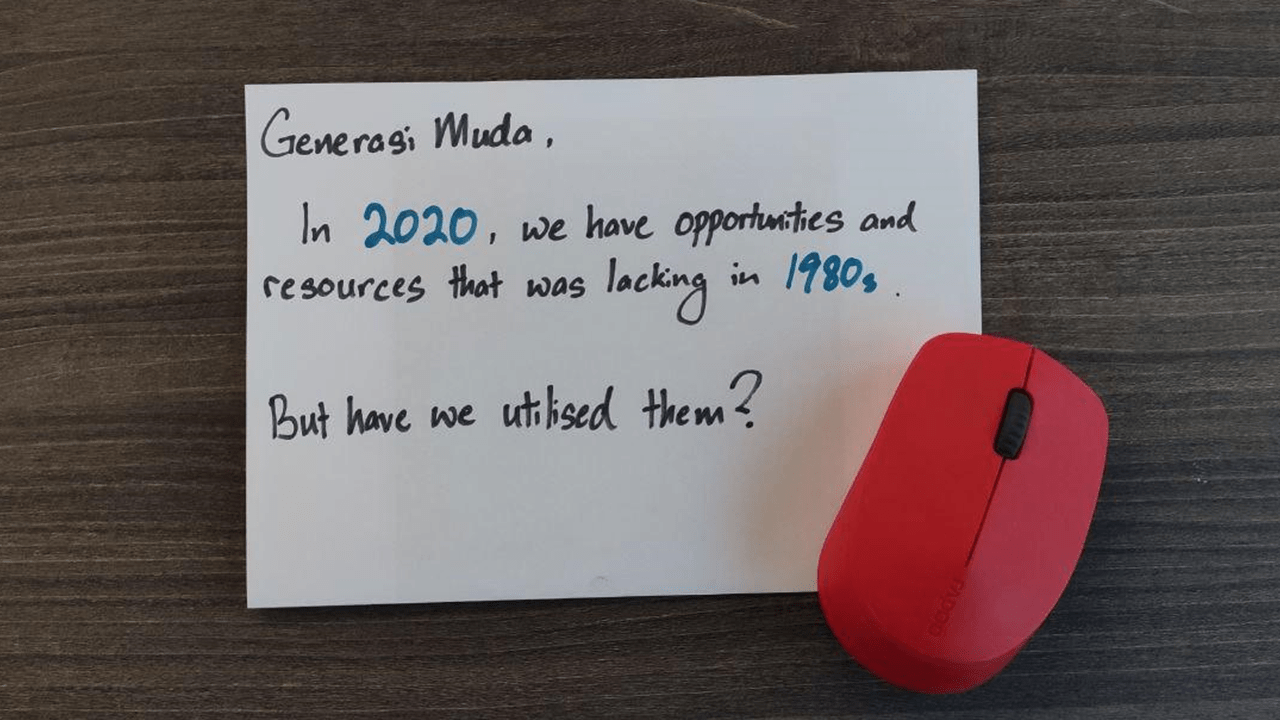

With all due respect, I feel that the argument was only one-sided. This is because, in 2020, we have plenty of resources and opportunities other than just money. Our ‘kemampuan diri sendiri’ or our potential ability in this society have never been higher, bigger, wider.

Yes, cash is indeed king. When it comes to upgrading our lifestyle, we are limited by the money we have in our bank account. However, have we – as a Generasi Muda, utilised all our resources and opportunities to earn the money we need to sustain our lifestyle?

Here are a few examples of resources and opportunities that is absent in the 1980s, but abundant for us in the year 2020:

1. Be part of the Gig Economy

The gig economy doesn’t necessarily mean driving for Grab or delivering for Food Panda. A “gig” or a short-term task/project can also be highly skilled and can be paid quite handsomely.

With the internet, you can easily be part of the gig economy. All you need is a little dedication outside your work hours to earn some extra income.

You will also need to identify what is your skill or passion, then find someone that will pay you for doing what you do best.

Personally, during my spare time, I have been building websites for small businesses that want a simple online presence. Each project I will charge them anywhere between RM2,000 to RM2,500. It is possible to build 2-3 websites each month (provided that the client can give me the information and content on time).

Recently, I was also approached by a company to be their freelance writer and they offer me RM1,000 for a 1,000-word article. Not bad. Here’s an article by Suraya, a well-known personal finance blogger in Malaysia, about her experience on writing.

Some of you may claim that I do not have a “work-life balance”. But this is my life, if I want to enjoy a better lifestyle, these are the resources and opportunities I must use to exchange for money.

I don’t think this opportunity is present during the 1980s because if you were to take a part-time job, you need to be on the job, instead of working remotely and at your own pace.

2. The ability to learn a new skill online (for free)

You may say, “But, what if I don’t have any relevant skills”.

It has never been easier to learn a new skill in 2020. Being trained as an accountant, I have zero knowledge on how to build a website.

However, this doesn’t deter me from learning online. I bet you can learn any skills you want to learn online if you put in the time and effort.

A simple search on YouTube gives me so many videos on “How to build a website”. I started watching a few of them and spent hours tinkering with the website before I started charging my first client.

You may not be interested in building websites, but if you always wanted to play the guitar, you can learn how to play a guitar from YouTube. You can also learn how to draw comics from YouTube. The possibilities are endless. Every skill that you want to learn is literally at your fingertips.

Thus, here’s another resource/opportunity we can use that most take for granted.

Taking things for granted cost money!

3. Networking

As the saying goes, “Your Network is Your Net-worth”.

In the 1980s, events of common interest are not as easy to find as compared to today.

It is so easy to discover events that are on-going around you in 2020. Using sites like Eventbrite or Peatix, you can find many free events that may be interesting to you.

Then, from these events, you may know someone that has the same interest.

I am not saying all events on Eventbrite or Peatix are great events, but the idea of joining events like this is to talk to people outside your normal circle of friends. By talking to new people, you may learn something or discover something that you may not know in the past.

4. The Weak Ringgit

Yes, the Ringgit is weaker against the US Dollar, this is a fact.

I must admit that there is nothing much we can do, besides spending less on overseas vacation and limit our exposure to purchasing goods from other countries.

However, this can also be an opportunity. With the internet, we have direct access to the oversea market. If we position ourselves well, our service may be seen to be more attractive due to the cheaper Ringgit.

I may start to reach out to other countries to offer my website building service, maybe, just maybe 😉

5. More Investment Options

As mentioned, the increase in the cost of living and the diminishing purchasing power is known as inflation.

Inflation is a double-edged sword.

If you are standing from the consumers’ point of view, yes, you will get upset when things get expensive.

However, if you’re standing from the business’ point of view, you will be happy that your product is selling at a higher price.

I am not saying that everyone should start a business because it is easier now to “own a piece of the business”.

There are plenty of investment options out there. And it has never been easier to invest. Investing these days is just as easy as registering for a Facebook account.

The basic reason why everyone should invest is to beat inflation. Using the original post as an example, if someone bought the One-Storey Terrace House at RM25,000, do you think he would complain if the price went up 11 times? I think he may want the price to go up higher.

Final thoughts

Yes, if you look at our salary compared with the cost of living, it is not catching up with some of our living expenses (not all). However, as a Generasi Muda, we have more options, opportunities, and resources that we do not properly utilise.

Instead of learning a useful skill on YouTube, we binge-watch on silly prank videos.

Instead of networking with people of the same interest, we spend time on Tinder and never meet the 365 matches in real life.

Instead of taking the opportunity to offer our service overseas, we take the easy route and point our fingers, blaming both governments on the weak Ringgit.

Instead of buying into companies, we spend more and more time and money shopping online.

In the end, it all comes down to how effective you identify and use the resources around you. A change in perspective can make a big difference. To end this article, I am going to leaving this quote by a local entrepreneur here:

![[Side Hustle] Hustling For a Bigger Investment Capital](https://plannerd.io/wp-content/uploads/2022/08/Cover.jpg)