Be Part of the Future

300 new financial planners* have joined the industry in 2021, don't be left behind

*Source: Securities Commission's Electronic Licensing Application

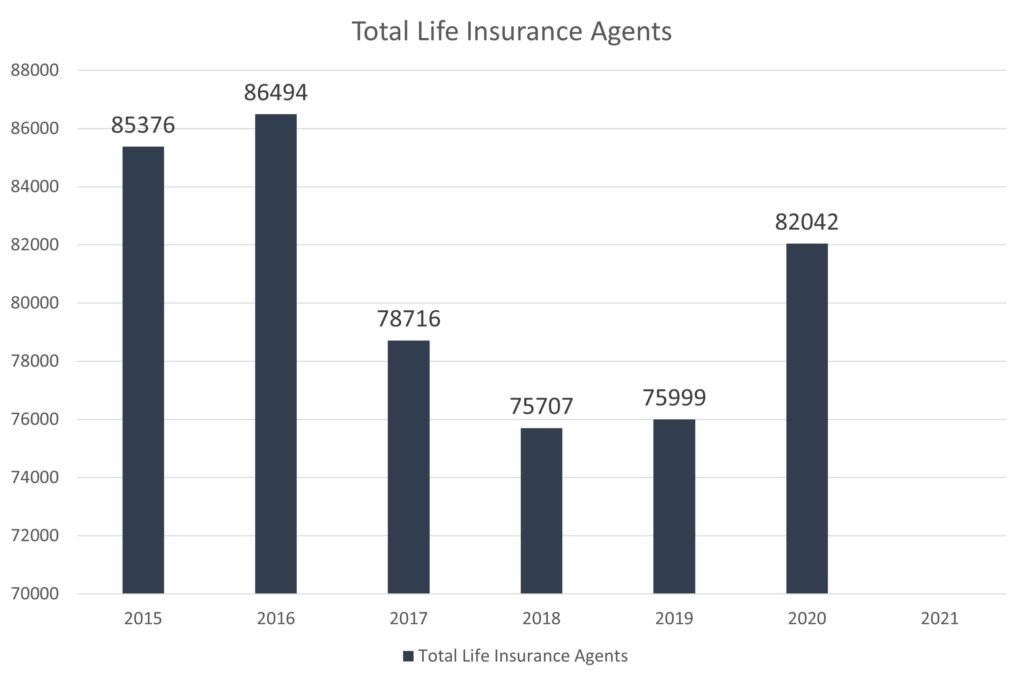

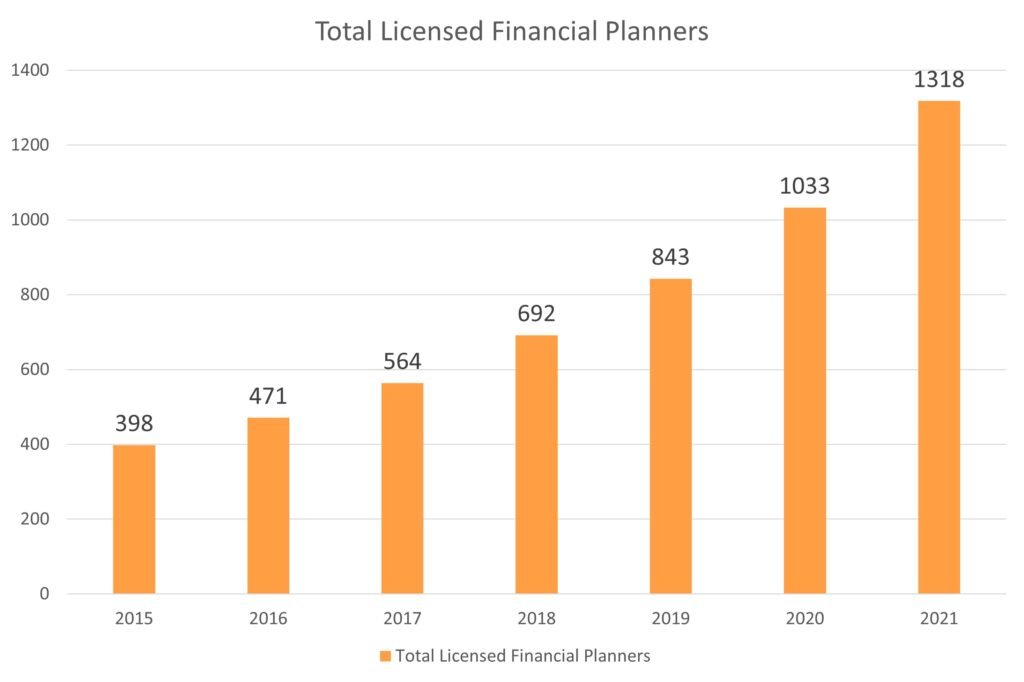

Financial Services Industry Trend

Life Insurance Agent vs Licensed Financial Planner

Source: Annual Reports, LIAM

Source: Securities Commission's Electronic Licensing Application

Huge Potential for Licensed Financial Planners in 2022

The 2 charts above shows the number of Life Insurance Agents vs the growth of Licensed Financial Planners in Malaysia respectively.

Licensed financial planners are showing a constant growth throughout the years.

In year 2021, we have seen the number of licensed financial planners increase by close to 300 new financial planners.

Represent Your Client's Interest

Giving more options that suit your clients' needs

Life Insurance Agents:

One Company, Limited Solutions

Licensed Financial Planners:

Multiple Companies, Various Solutions

Major difference between an Insurance Agent and a Licensed Financial Planner

Life Insurance Agents represent the Insurer to look for clients, whereas Licensed Financial Planners represent the client to look for insurance.

When it comes to insurance in Malaysia, there is no clear winner. Every insurance company have their unique strength.

Licensed financial planners can choose the best of class product for their clients from multiple insurance companies.

As a licensed financial planner, you can offer products from A company to G company to P company and back to A company again.

Have access to these wide range of products and solutions from our partners.

- AIA

- Allianz

- AmMetLife

- Etiqa Life

- Gibraltar BSN

- Great Eastern

- Hong Leong Assurance

- Manulife Insurance

- MCIS Insurance

- Prudential

- Tokio Marine Life Insurance

- Zurich Life Insurance

- AIA Public Takaful

- Etiqa Family Takaful

- Takaful Malaysia

- Takaful Ikhlas

- AIA General

- Allianz General

- AXA Affin General

- Chubb Insurance

- Great Eastern General

- Lonpac Insurance

- Liberty Insurance

- MPI Generali

- Pacific Insurance

- QBE Insurance

- Tokio Marine Insurance

- Tune Insurance

- iFAST

- Kenanga

- Phillip Mutual

- RHB Trustees

- Rockwills

- Funding Societies

- Sinegy

- FinSource

- ManagedCare

Craft Your Own Journey

Based on your strength, design the career path that suits you best

10 Possible Sources of Income |

|---|

Unit Trust Upfront Fee |

Unit Trust Wrap Fee |

Unit Trust Trailer Fee |

Life Insurance Commission |

Life Insurance Product Comparison Fee |

General Insurance Commission |

Group Insurance Commission |

Advisory Fees |

Estate Planning Fee |

Other Referral Fee |

Specialize in areas that you will do best

As shown in the table above, being a licensed financial planner allows you to have the flexibility to determine how you want to grow your career.

With various ways to earn an income as a financial planner, you may choose the path that suits you best.

In-house Expert Support

Done-for-you updates on new products/solutions on the market

In-house Company Experts

Periodic updates on the financial markets

Learn about the latest market updates from our inhouse experts

Clients may have higher expectations if you are a licensed financial planner. But let’s be frank, we may not know everything that is happening around us.

Fret not!

Our company have in-house experts that will provide you with monthly factsheets* and comparison* of various products and frequent updates on the financial market.

Success is a Decision

Be part of the leading Independent FA Group in Singapore and Malaysia

Have a strong starting point

FA Advisory (Malaysia) is part of the Financial Alliance Group in Singapore.

Being part of the Financial Alliance Group not only provides you with the best-in-class support and technology, but also the opportunity to access to cross-border knowledge and solutions.

Connect with colleagues from Singapore for potential collaboration and knowledge transfer.

Automate Your Work

Leverage on our technology to build your career

Planning Tools

CRM System

Backend Support

Online Profile

Marketing Support

Embrace technology to propel your career to further lengths

Using existing technology within the group, consultants will access to the following benefits:

- Planning Tools – Easy to understand charts to help you illustrate to your clients.

- CRM Systems – Record every little details about your client and automate emails to nurture the relationship.

- Backend Support – All information about the product and services you implemented under one-roof.

- Online Profile – Build your very own web page to display your services and expertise.

- Marketing Support – Dedicated digital marketing support to assist with your online campaigns.