As a financial planner, I get this question a lot: What insurance should I get? Last year, I wrote about my confession as an insurance agent. I briefly covered on why it seems like there is a lot of insurance to choose from, but eventually, it all comes down to 3 main ones:

- Medical Card,

- Personal Accident, and

- Income Protection

Alright, this is an easy topic, my shortest blog post ever! Thank you very much for reading.

You need more?

Alright, if you need more information, let me warn you that there are actually a lot more details for me to share. But if you are just a person that doesn’t really want to know the mechanics behind your insurance policies, just get someone you can trust and get the 3 types of insurance as mentioned in the paragraph above.

Medical Card

Anyone that sells you any insurance other than a Medical Card first should be burned in hell. Unless you have reasons such as a pre-existing illness that insurance companies will not accept your offer, you should get a medical card first.

IF you are an agent reading this, alright alright, sometimes there are some clients that will ask “can I get back my money after X number of years ar?” And you have no choice but to give them what they want.

That’s the purpose of this article, I hope everyone that reads this should know that a medical card is the most important insurance you buy. There’s also a philosophical reason why we should get a medical card, but I will cover that later.

Why you need a medical card first

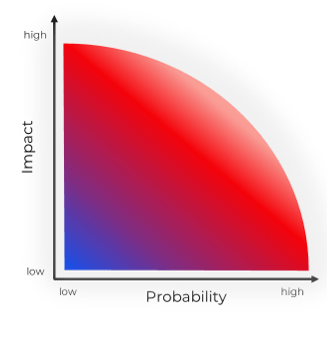

When it comes to insurance, it all boils down to 2 things: probability, and impact.

Let’s quickly go through which event will have a higher chance of happening:

- Admitted to a hospital,

- Accidents – can be in the form of major traffic accidents to falling into a drain, or

- Death, permanently disabled, or contracting critical illnesses

Some of you may think that accidents can happen anytime or having heart disease is very common nowadays. But no matter which event it is, there is a high chance that you are required to be treated or hospitalized.

Being hospitalized can also bring a huge impact on your financials. I was admitted for dengue in 2016, the hospital bill cost about RM12,000 for 10 days in the hospital. If I didn’t have a medical card, it will definitely cause a huge dent in my finances. The bill can be a lot higher if it was a serious disease.

Therefore, this is the reason why I believe a medical card is the most important insurance and everyone must get it first.

How to choose the correct Medical Card

If you are in the market looking for a medical card for you or your family, these are a few important points you must take note:

- Room and Board coverage – at least RM200

- Annual Limit – at least RM1,000,000

- Lifetime Limit – No Limit

- Outpatient Kidney Dialysis – As Charged

- Outpatient Cancer Treatment – As Charged

The above are the basic requirements of a modern medical card. Of course, there are plenty of other minor benefits, but these are not essential in my opinion.

However, if you are on a budget, you may opt for a medical card with a deductible.

A deductible simply means that you have to pay a certain amount first before you can claim for your insurance. For example, if my medical card has a deductible of RM5,000, I will need to pay RM5,000 to the hospital before I can claim from my medical card.

This will greatly reduce the cost of insurance, and for the above example, it will lower down the cost by 40% for a male in his early 30s.

Which company to buy from

Generally, buying from any company is fine as long as they meet the above basic requirements. To make your life easier, here are some companies that offer different types of medical card. (Please note that this is not a full list and insurance companies update their line of product from time to time, it is better to check with your insurance agent or financial planner on the latest updates.)

Standalone Medical Card – No Deductible

- AIA

- Great Eastern

- Hong Leong Assurance

Standalone Medical Card – With Deductible

- AIA

- AXA Affin

- Hong Leong Assurance

Investment-Linked Attached Medical Card – No Deductible

- AIA

- Allianz

- Great Eastern

- Prudential

- Tokio Marine

Investment-Linked Attached Medical Card – With Deductible

- AIA

- Allianz

- Great Eastern

- Prudential

- Tokio Marine

You can search for insurance agents from these companies to help you to generate the quotation for you, or you can also write an email to me (Marshall@plannerd.io) if you want us to generate a quotation for you. I am also looking for insurance agents to help me out. If you are an insurance agent, you can also drop me an email if you would like to help to generate these quotations.

Getting a Medical Card is a Noble Act

I am passionate to learn more about a country’s economy and macroeconomics in general. The more I learn, the more I discover underlying problems within our society. One serious problem with our economy is the wealth gap, and I highlighted in this article that it is very expensive to be poor.

Besides protecting you and your family’s finances, getting a medical card also helps the poor. Our public healthcare system is actually quite good. As Malaysians, we can get relatively good treatments in government hospitals at a low price. So, with good and affordable public health care, why do we need a medical card?

Even though we can receive good and affordable treatment, but the public healthcare in Malaysia suffers a bad reputation for the time needed to wait for the treatment. If everyone that can afford a medical card seeks treatment in private hospitals, this will lift a lot of burden from the healthcare system.

This will in turn shorten the time needed to treat other people that cannot afford to pay RM1,000 a year to get a medical card. They will get proper treatment in a timely manner, which could mean saving their lives.

Last Words

I started writing this article, and the plan was to explain everything in a single blog post. As I was writing, I got carried away and realized that this gets longer than expected.

If you choose to research on getting the best insurance policy for yourself, there is a lot of details you need to cover.

I will do my best to explain them in my articles. Let me know if you do not understand or would like me to elaborate on my points above in the comment section below.

In my next article, I will explain the importance of a Personal Accident Plan. A personal accident plan is an under-rated insurance that is very effective and cost-efficient for people below the age of 40.

Be sure to stay tuned to my Facebook, Instagram, or LinkedIn profile to get the latest updates.

![[Side Hustle] Hustling For a Bigger Investment Capital](https://plannerd.io/wp-content/uploads/2022/08/Cover.jpg)