Among the Chinese, there is a saying: “再穷也不能穷教育”, which translates to “Education shouldn’t be sacrificed even if we’re poor”.

Parents believe that when their children are educated, they can secure a higher income and getting better opportunities in life, thus contributing back to the family and the society in various aspects.

However, most parents will think that they have sufficient time to prepare for their children’s education, and therefore prioritising on providing their children with other “needs” such as bringing them for a luxurious vacation or other forms of entertainment.

Just like any investments, time can be your friend, or it can be your worst enemy. If you are a parent with young children, why not start preparing the best AngPao you can give to your children now.

To start planning for your children’s education fund, you should:

1. Estimating the cost of education

When estimating the cost of education, consider the following factors:

- The type of studies your child may pursue.

- Will you send your child to attend a local or an overseas university?

- How much is the basic cost of living should your child is attending an overseas university?

Information on the fee structure and the overall cost of living are readily accessible on the internet. You can refer to this website to learn more about the fees and cost of education in Malaysia.

However, it is important to bear in mind that these factors may change over time. You should be reviewing the plan at least once a year to keep yourself updated on the latest developments and make sure to get the information from various sources to ensure that the cost of education and overall cost of living falls within a similar range.

2. Understand your current financial position

Now you know how much is needed to reach point B (cost of education), to calculate how much you need to set aside every month to cover the shortfall, you will also need to know how much you currently have, point A.

Most people store their wealth in the form of cash, properties, and other types of investments. You should ask yourself; how many portion of the above-mentioned assets can be allocated for your children’s education?

For example, you may want to allocate 10% to 20% of your cash for the sole purpose to fund your children’s education. If you have investment properties, you may also designate a property to be sold once your child reaches 18 years old. Some may even have endowment policies with insurance companies that may mature in 20 years.

The key is to write down a list of assets that you will dedicate its sole purpose as your children’s education fund.

3. Determine how much is needed to cover the shortfall for your children’s education

In this step, we will be using a free financial calculator available online to easily calculate how much do you need to save/invest for your children’s education. You can access the calculator HERE.

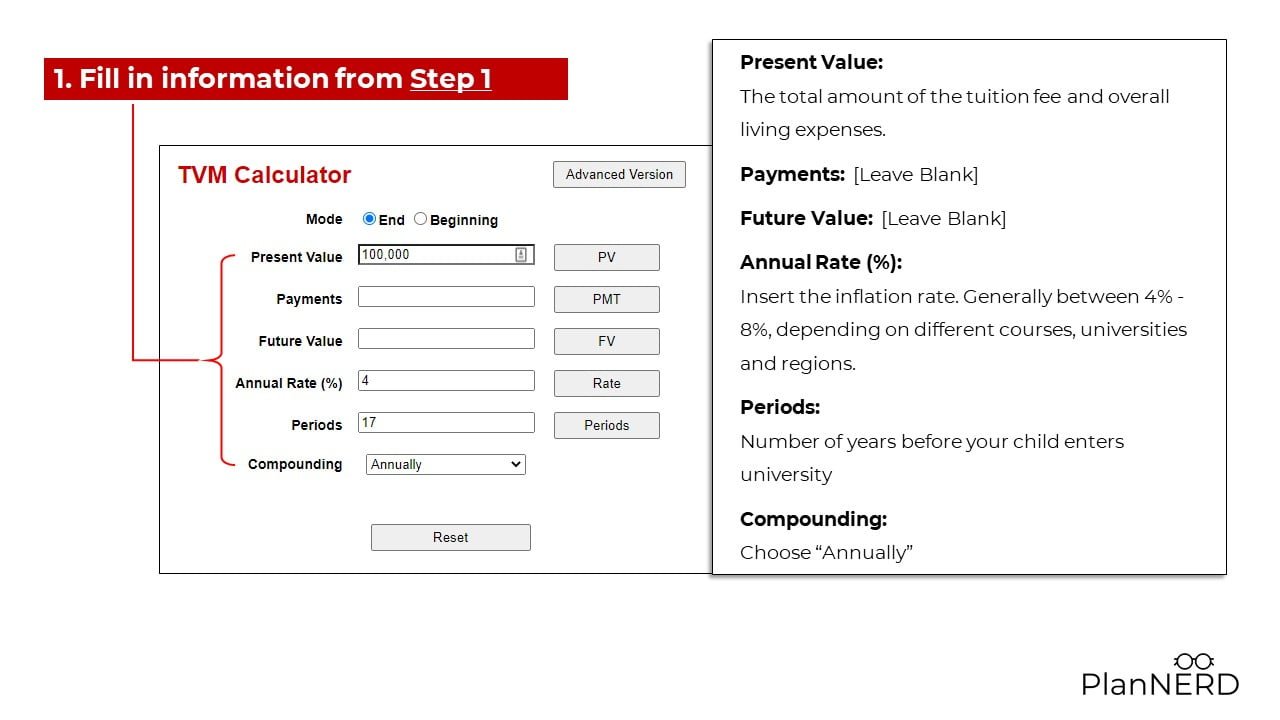

(i) Enter the following field with the information you had prepared in Step 1 above.

(ii) Click on “FV”

The amount in the FUTURE VALUE box is the future value of the education cost that you entered.

In this case, the cost of education today is RM100,000. However, with an inflation of 4% for the next 17 years, the cost of education will be increased to RM194,790.05 when your child is ready to enter university.

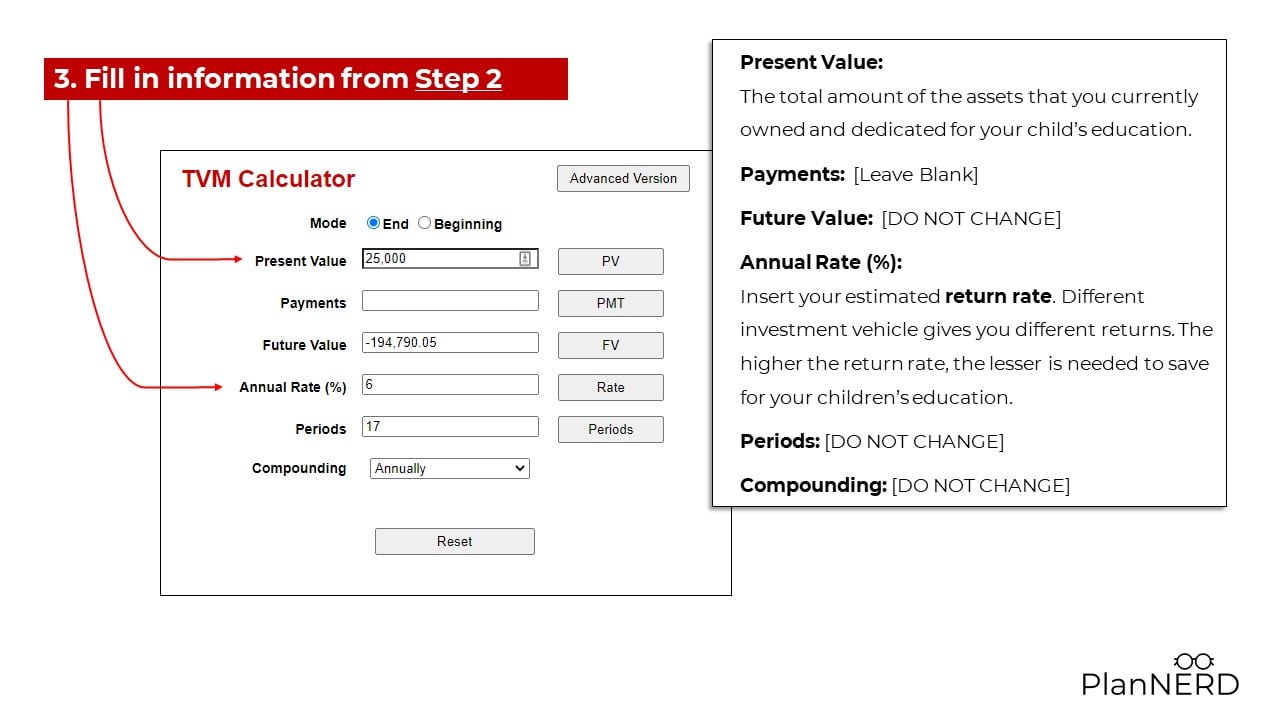

(iii) Update the “Present Value” and “Annual Rate” field

Next, you will need to calculate how much more is needed to cover the shortfall.

Using the same example as the above, assuming that you have RM25,000 now and you believe that you can achieve an average of 6% return rate for the next 17 years, update the Present Value and Annual Rate (%) column.

(NOTE: do not refresh the website or change any other information.)

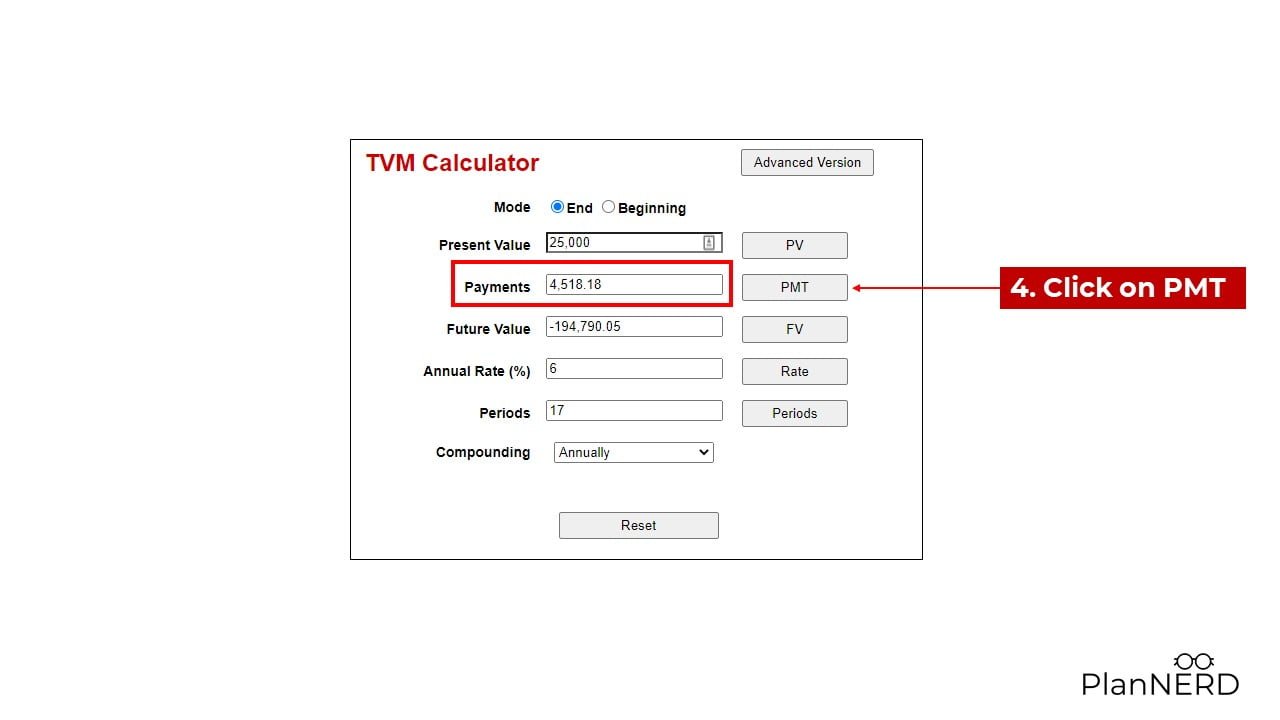

(iv) Click on “PMT”

The last step is to click on “PMT” to calculate the amount needed to save/invest every year to cover the shortfall in your children’s education fund.

In this example, you will need to save RM4,518.18 every year, or roughly RM400 every month (with a return rate of 6%) to send your child to a private university in Malaysia, 17 years later.

4. Choosing the correct financial vehicle

There are plenty of choices when it comes to choosing an investment vehicle. However, we all know that most investment journey isn’t likely going to be smooth sailing all the time, therefore it is very important to follow the 3 rules of investing as covered by Bryan Zeng, General Manager of FA Advisory, a subsidiary of Financial Alliance, the largest Independent Financial Advisory firm in Singapore.

Preserve your investment capital

In Bryan’s article, one important rule that is applicable in investing for children’s education is to preserve your investment capital. Sometimes, we can allocate a small portion of our portfolio to invest in high-risk investments. However, you do not what to do that with your children’s education portfolio.

In his article, he illustrated that in order to recover from a 10% loss on our investment, we need to have 11% gain to return to the original capital position, a 25% loss would require a 33% gain to break even, so on and so forth.

There is no such thing as the best investment, what is good for me may not necessarily be good for you.

However, having said that, when it comes to investing for children’s education, you may want to pay some attention to PTPTN’s National Education Saving Scheme, or commonly known as SSPN. Parents saving money into SSPN-I can enjoy tax relief of up to RM8,000 per year.

Keep your eyes on the prize

Lastly, keep your eyes on the prize. Always remember your why. Constantly review your investment strategy to ensure that you do receive any unfavourable surprises when your children is approaching the age to register for a tertiary education.

5. Avoid common education planning pitfalls

Ignoring Retirement Planning

If we are unable to cover the shortfall as calculated earlier, there are other ways to ensure that our children will receive a decent education, such as applying for an education loan from PTPTN or applying for a local public university.

However, there are fewer options available if we can’t cover the shortfall in our retirement planning.

Trusting the Wrong “Advisor”

Many fraudulent “advisors” uses the element of fear and greed in parents to convince them to invest in their unregulated investment products. Should you need the help of a third party in the education planning process, ensure that you engage a licensed representative. I wrote about 5 important factors to choose a financial planner in this article.

Not Reviewing Saving and Investment

I may sound like a broken record by now but reviewing your investments and portfolio at least once a year is very important. If needed, you should also rebalance your portfolio to ensure they meet the objective of providing X amount of money Y years later.

Conclusion

Saving for your children’s education is a long-term goal that may seem like a huge commitment at first. With a carefully planned strategy, and making Time your friend, not enemy eases the process significantly. No matter how much the amount is, start today. The earlier you start, the better is the compounding effect, because:

“Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.”

![[Side Hustle] Hustling For a Bigger Investment Capital](https://plannerd.io/wp-content/uploads/2022/08/Cover.jpg)