The Ultimate Guide to:

How to become an Independent Financial Advisor

Written by: Marshall Wong, Licensed Financial Planner

I remember the days when I wanted to learn more about how to become an independent financial advisor, there aren’t many resources available on Google.

Till today, the resources are still very limited.

To make matters even more confusing, words like “financial planner”, “financial advisor”, “wealth planner” and “certified financial planner” are often use interchangeably. They are actually different.

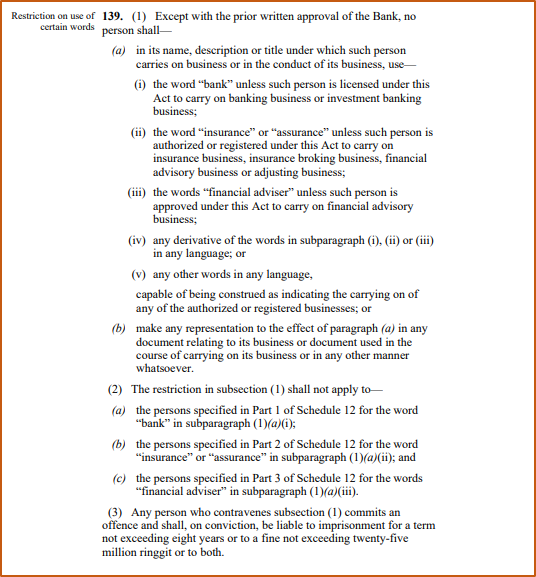

(If you didn’t know already, in Malaysia, if you falsely claim yourself as a “financial advisor” without the necessary license, you may be fine for RM25 million – Financial Services Act 2013)

In this guide, you’ll find all the information that you need to be an independent financial advisor in Malaysia.

You’ll learn the difference of a “financial planner” and a “financial adviser”, along with their respective scope of work.

Keep on reading to understand the financial planning industry or use the side-bar on the left to jump ahead to the section that interest you most.

What is an Independent Financial Advisor?

Independent Financial Advisors (IFA) are professionals who offer independent advice on financial matters to their client. They offer a full range of financial services and providing solutions from multiple financial institutions.

When asked to explain what an Independent Financial Advisor (IFA) do, I often say that he/she is a professional that represents the client’s best interest instead of being an agent to a financial institution (Insurance companies, banks, fund houses).

The financial services industry can be categorised into 3 titles:

Tied-Agents

Being a tied-agent means that he/she can only advise/sell products that are offered by the company that they represent.

As a tied-agent, they are often limited by the products of their principal company, and do not have an option to offer their clients a wide range of products from other financial institution.

Brokers

Unlike a tied-agent, a broker can offer solutions from a wide range of companies.

However, brokers often focus on providing just one area of solution. For example, a company may only offer insurance services to their client, without providing investment solutions.

Independent Financial Advisors

An IFA is someone that is capable of providing solutions from a wide range of companies across various types of services.

Clients can seek for a comprehensive and independent advice from IFAs as their advice is not limited to the products by just one company or one area of focus.

I have also written a separate articles for more detailed explanation breaking down the 6 steps of what does an IFA do and how an IFA makes money.

License Requirements for an Independent Financial Advisor

In order for IFAs to provide an independent and comprehensive financial advice, he/she needs to hold the following 3 licenses:

Capital Market Service Representative Licence (CMSRL)

The CMSRL license is regulated by the Securities Commission of Malaysia.

This allows the IFA to conduct financial planning activities and provide financial planning services with a fee. You may search for all Licensed Financial Planners HERE.

At the time of writing, 20 February 2022, there are a total of 1,363 Licensed Financial Planners – an increase of more than 300 consultants, or about 30% compared to just a year ago.

Financial Advisor Representative Licence (FAR License)

The FAR License is regulated by Bank Negara Malaysia.

This allows the IFA to identify and analyse the client’s needs and search for the suitable insurance solutions.

Corporate Unit Trust Adviser (CUTA)

Last but not least, the CUTA license is registered with the Federation of Investment Management Malaysia (FIMM).

FIMM regulates the marketing and distribution of Unit Trust and Private Retirement Schemes. With a CUTA license, the IFA is allowed to provide Unit Trust solutions to clients.

You may check the validity of an IFA’s license HERE.

Financial Planners vs Financial Advisers

In the beginning of this guide, I mentioned that it was confusing – even for industry practitioners to grasp the different jargons used.

In Malaysia, we have 2 main regulators governing different scopes of the financial services industry – Securities Commission of Malaysia and Bank Negara Malaysia.

They have different definition for different terms, let us explore below:

Financial Planner

Financial planners are registered with the Securities Commission of Malaysia, as mentioned above, one can use the designation if they hold the CMSRL license.

Financial Advisers are registered with Bank Negara Malaysia. Unlike financial planners, financial advisers means a company that is holding the license, not an individual.

Individuals like me are called the Financial Adviser’s Representatives, or in short FARs.

So, what is an Independent Financial Advisor (IFA)?

An Independent Financial Advisor is just a common, loosely used term in the industry that means an individual that is holding all 3 licenses, which is:

- Capital Market Service Representative Licence, CMSRL

- Financial Advisor Representative Licence, FAR

- Corporate Unit Trust Adviser, CUTA

Future Developments

Thankfully, in September 2021, it was reported that the Securities Commission and Bank Negara Malaysia is looking into consolidation of the licensing regime. However, at the time of writing (20 February 2022), there hasn’t been any updates.

Feel free to drop your email address here to receive updates in the financial planning industry:

How to become an Independent Financial Advisor

To become an Independent Financial Advisor in Malaysia, you will first need to obtain all 3 licenses, which is the CMSRL, FAR and CUTA license as mentioned above.

Even though there are 3 different licenses to be applied before you can become an independent financial advisor, luckily, the process and requirements are almost the same.

Step 1: Get Professionally Qualified

In order to apply for the CMSLR and FAR license, you are required to possess the minimum qualification of either:

- Registered Financial Planner (RFP);

- Certified Financial Planner (CFP);

- Shariah RFP; and/or

- Islamic Financial Planner (IFP)

You may opt for Shariah RFP or IFP should you want to apply for the Islamic Financial Advisers Representative License.

(Update: I have written a post to share more detailed explanation on each qualification, click to Learn More)

CFP vs RFP (Certified Financial Planner vs Registered Financial Planner)

To become an Independent Financial Advisor, you are required to pass all modules in CFP or RFP. However, the common question that most people will ask is, which qualification should I get, CFP or RFP?

Here are some differences that I noticed between the 2 qualifications:

- Both CFP and RFP are recognised in Malaysia, however, as CFP is an international qualification, it is accepted in other countries as well.

- CFP candidates must be enrolled with an approved Education Provider, whereas it is possible to self-study for RFP.

- As RFP allows candidates to self-study for the examination, the cost of taking RFP may be lower than CFP.

- Both qualifications offer different exemptions of module based on their existing qualification. If you are someone with relevant qualification/experience, you may check on their respective website: CFP, RFP.

In my opinion, if your objective is to become an Independent Financial Advisor, it really doesn’t matter which qualification you take.

What’s more important is the on-the-job experience as the world of personal finance is ever-changing and the continuous learning that you will be receiving after becoming an IFA.

Nevertheless, here’s an experience shared by Suraya from RinggitOhRinggit.com, her journey of getting her CFP.

Can a Shariah qualified FAR advice on conventional financial products, or vice-versa?

No. According to Bank Negara, a Shariah qualified Islamic FAR cannot advice on (conventional) insurance products unless the Islamic FAR obtains the minimum requisite qualification to be a FAR. The same applies to a FAR who wants to advise on takaful products.

Hence, if you plan to provide both conventional and Islamic financial advice, you should consider getting both conventional and Shariah qualification.

I have been working in the financial industry for many years, is there any fast-track to be qualified?

Yes. Both CFP and RFP offers fast-track solutions for practitioners with the required years of experience in the industry.

CFP – Challenge Status

- Years of experience required: 3 years

- Relevant areas of practice: insurance, mutual funds, securities, asset management, accounting, estate planning, banking, taxation, trusts, retirement planning and financial planning

With the above-mentioned experience, you will be exempted from Module 1, 2 and 3. However, you are still required to complete Module 4 – Financial Plan Construction and Professional Responsibilities.

Candidates are only allowed 3 consecutive attempts under the CFP – Challenge Status, failing which candidates are required to take Module 1, 2 and 3.

Source: FPAM

RFP – Capstone Programme

- Years of experience required: 3 years, and

- Relevant areas of practice: financial related industry, and

- Financial Planning qualification: Shariah RFP, CFP, CIFP (Part 1), or

- Membership of MIA, MICPA, CPA (Aust.), ACCA, Bar Council, ICSA, MAICSA, CIMA, or

- Relevant PhD, Masters, or bachelor’s degree.

Just like CFP, with the presence of the above-mentioned experience and requirement, you will be exempted from Module 1 – 6, and only required to complete Module 7 – Applications in Financial Planning.

However, there is no mentioned on the number of re-takes under the RFP Capstone Programme.

Source: MFPC

Step 2: Join a Financial Advisory Firm

Many people confuses that once they pass all their exam, they are a Registered Financial Planner or a Certified Financial Planner, and thus may use the title Financial Planner freely.

This is actually not true. In order to use the term financial planner, one has to obtain the CMSRL from Securities Commission.

And in order to obtain all 3 licenses from the above-mentioned regulators, you will need to join a financial advisory firm.

There are many financial advisory firms in Malaysia, however, if you want to become an independent financial advisor, here’s a few key considerations that you may want to take note.

Choose a firm that hold all 3 licenses

Not all financial advisory firms are built equal. Every firm have their own company goal and objective.

For example, some firms want to focus only on insurance, and hence obtaining only the Financial Adviser license from Bank Negara.

I have consolidated the list of all financial advisory firms with their respective license below:

- Financial Adviser License – Bank Negara

- Capital Market Services License – Securities Commission

- Corporate UTS Adviser- FIMM

If your objective is to become an independent financial advisor in Malaysia, join a firm that holds all 3 licenses.

Choose a firm with in-house product/market specialist

One of the downsides of being an IFA is the sheer amount of market and product updates from the providers.

Having multiple products to cater to different client’s needs is handy, but if every company updates their product once every quarter, we will be attending product and market training multiple times a week!

Thus, it is very important to ask if the firm you choose have an in-house product/market specialist.

When I join a firm, I didn’t notice the importance of having this in-house specialist until I was overwhelmed by the number of trainings provided by our providers.

Our in-house specialist will consolidate all the products and solutions available in the market and prepare a summary. This saves me lots of time as I do not need to go into detail for every-single-product.

Choose a firm with great technology and back-end support

Besides having to deal with product updates, being an IFA also means that you will be dealing with forms and different processes from multiple providers.

Even though physical paperwork has been greatly reduced, thanks to the implementation of non-Face-to-Face processes, it is still quite troublesome to handle multiple log-in pages from different companies.

Hence, without the help of technology and back-end support from the company, you may need to handle all of the administrative processes yourself – taking away precious time that you could use to focus on providing a great service to your client and other marketing activities.

Choose a firm with ready-made marketing materials

Even though it is the job of the IFA to find and secure their own clients, it is helpful if the firm that you join is active in its marketing efforts.

Instead of creating marketing materials from scratch, a good firm will provide their consultants opportunities to learn and to be present in firms marketing materials.

This will give new consultants a great head-start in the initial phase of their career.

Having a CRM system that helps consultant categorize and send periodic update to client is also a great bonus.

Choose a firm with great people

Even though an IFA covers a wide range of service areas and products/solutions, it is close to impossible to master and specialize in every aspect of personal finance.

Having great colleagues allow you to tap into their knowledge and experience in an instant in addition to the firm’s in-house expert.

If I want to know more about A, I will ask Mr. X.

If I want to know more about B, I will ask Ms. Y.

If I want to know more about C, I will ask Mrs. Z.

You get the point.

It’s not only about technical knowledge, having great colleagues allow you to explore ideas and plans for different client’s needs.

If your client is facing a difficult situation that you do not have the experience, probably a colleague of yours have met with the same scenario with their client and will offer their advice.

You may also collaborate with your colleague on marketing initiatives. This will reduce the burden on you greatly.

Other miscellaneous considerations

Before becoming a representative of a financial advisory firm, they will offer you an Engagement Letter that states the contractual relationship between you and the firm.

It is important to read the letter thoroughly and understand the terms within. Always ask questions if you are not clear with the terms within the letter.

After all, you are also planning for your own future.

Step 3: Apply for your license and always remember to learn and adapt

Congratulations, you have come a long way. Once are you accepted by a financial advisory firm, you will need to apply for all 3 licenses.

However, you do not need to do this on your own. As mentioned above, a good firm with a strong admin support will help you with your application.

You will need to focus on the on-boarding process. The amount of solution that you can provide as an IFA can be a distraction, however, I believe that most financial advisory firms will have their unique onboarding process and trainings for new consultant.

You can also choose an area of focus to start with, and gradually progress towards providing a holistic financial advice.

FAQs

As like most things in life, nothing is perfect. I believe that every firm has its pros and cons. However, I would say I have no regrets joining my company. If you are keen to explore, do drop me a message here.

Technically, no. However, you can join a firm as an associate and guided by another IFA while studying for your professional paper. This may be a good option to be hands-on with real financial planning scenarios and will eventually help during your exams.

In general, there are 3 types of remuneration:

- Commission-only;

- Fee-based; and/or

- Fee-only.

Commission only, as the name suggest, IFAs are remunerated by the commission of the products they implemented for the client. This is very similar to the remuneration structure of insurance agents or unit trust consultants.

Fee-based, is a hybrid between commission-only and fee-only. The IFA will charge an initial fee during the planning process and also will receive commission pay-out from the products implemented for the client.

Fee-only, is mostly seen when servicing ultra-high-networth clients. The IFA only charges a predetermined fee for the client and do not receive any remuneration from life insurance providers or fund companies.

No. However, the IFA’s fee will be based on the job scope needed by the client coupled with the experience of the said IFA.

No. According to Bank Negara (1.7.20), you will still receive your renewal commission even if you have become a Financial Adviser’s Representative (FAR), provided you achieve a persistency of at least 85% on your individual sale.

If you were an agency leader, your previous insurer will also pay your overriding commission from your previous tied-agents’ block of business.

I am representing FA Advisory.

As like most things in life, nothing is perfect. I believe that every firm has its pros and cons. However, I would say I have no regrets joining my company.

Conclusion

Being an IFA is a challenging, yet, rewarding career choice. From my personal experience, switching from being a tied-insurance-agent to an IFA allows me to have the necessary tools and solutions to provide to clients.

Is it demanding? Yes. But the technology have improved so much so that all the information I need as an IFA is on my fingertips.

I hope this guide helps everyone that is considering joining the financial advisory route easier. If needed, I will update this article from time to time to reflect the latest information.

Feel free to follow my social media accounts for other content and updates: