There are 405,441 households in Malaysia that are categorised as poor and living below the Poverty Line Income (PLI). These households have only RM2,208 per month (or less) to support the entire family.

To make matters worse, according to the World Bank Group, “COVID-19 and its associated economic crisis are reversing hard-won gains against global poverty, ending more than two decades of continuous progress.”

COVID-19 and its associated economic crisis are reversing hard-won gains against global poverty.

Source: Poverty and Shared Prosperity 2020

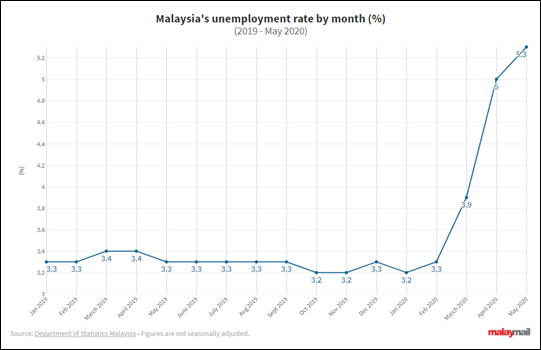

Coming back to Malaysia, we have seen the unemployment rate shot up to 5.3% in May 2020. The highest in recent years.

Source: Malay Mail

Okay okay…

It’s the pandemic ma…

Of course the numbers will be high..

Buckle your belts…

Tahan abit la…

Use the government hand-outs first…

The vaccine is almost here…

Everything will be back to normal…

Yes, all the above is true, only if you have cash buffers as emergency funds. However, for those that do not have emergency funds, and are living in poverty, this will never end until an external force (like receiving substantial hand-outs) intervenes.

This is the Poverty Trap

Imagine this:

Week 0 – You got a job.

Week 1 – You worked hard and is able to save some money.

Week 2 – Something bad happens and you will need to use that money to survive. This puts you back into the same situation in Week 0, or probably in a worse situation than Week 0.

This cycle repeats itself. The money you receive today does not necessarily help you make more money in the future because you have no resources to fall back on in the event of a financial setback.

Recently, there have been many motivational speakers and successful entrepreneurs backing the hustle culture. Forget entertainment, work as hard as possible.

This may work if we have the privilege of ‘another chance’. But when it comes to the extreme poor, with basic education and devoting all their time working, will they escape the poverty trap?

This reminds me of a documentary I’ve seen many years ago (link below):

The founder of G2000, a popular work apparel brand, Michael Tien believed that with great passion and determination, you can live the life that you always wanted.

He wanted to experience the life of the poor to prove that he has what it takes to become rich again. So, he went to one of the poorest areas in Hong Kong to be a cleaner.

However, working 17 hours a day, he realises that he still does not have money. In the documentary, he also experienced that it is very expensive to be poor. His rental expenses took half of his pay, and public transport to work was also too costly for him. He has to plan for every single meal which was once taken for granted.

He was physically exhausted. There is no time to think about his plans and the future. He admitted that the only “future” he can think of was what his next meal will be.

As a successful businessman, holding an MBA from Harvard, Tien realises that it is impossible to escape the poverty trap without external assistance.

Can Financial Planning Help Combat Poverty?

I think it is obvious by now, no amount of financial planning can lift someone out of poverty, let alone becoming rich. As a financial planner, the pre-requisite of taking in a client, is that the client must have a positive cash flow, or he/she must have reserves in the form of cash, or other assets.

This is also the same for financial education. There are countless articles and workshops on “How to be rich”, “How to be Financially Free”, “Steps to Financial Independence”…

But how many of these contents can actually reach the poor? Taking time to read and participate in these “self-development” activities is a luxury and this could mean that they will go hungry tomorrow. This was also mentioned in Poor Economics, written by 2019 Nobel Prize winners Abhijit Banerjee and Esther Duflo.

So, financial planning and financial education is only important for the rich?

With the above examples, it seems like financial planning and financial education is only meant for the rich. Well, yes, but there is also a huge group of people from the M40, or the middle-income group.

Those that find themselves in the lower end of the middle-income range, i.e. monthly household income of RM4,850 to RM7,099 are vulnerable to fall into the poverty trap.

A significant event like COVID-19 may tilt them slightly towards poverty. This will be the beginning of a slow but certain downward spiral that they eventually couldn’t escape.

Even though as a financial planner, I cannot help those that are already living in poverty. However, financial planners should focus more on the lower middle-income group as we can prevent them from the downward spiral.

At the very least, we should manage their ego and pride if they are facing certain financial setbacks. Because most of the time, it is their ego and pride of not willing to depart from their current lifestyle that eventually gets stuck with mountains of debts…

Also… maintaining a good budget.

![[Side Hustle] Hustling For a Bigger Investment Capital](https://plannerd.io/wp-content/uploads/2022/08/Cover.jpg)