If you are below the age of 40, you may want to pay attention to this article, this may potentially save you thousands of Ringgit in insurance premium.

Last week, I wrote an article about the 3 main types of insurance, and the first insurance you should get – the Medical Card.

In this article, let us discuss the most under-rated insurance – Personal Accident.

“Buying Insurance is to Transfer Financial Risk”

Buying insurance is to transfer financial risk should an unfortunate event happens. With this logic in mind, we should prioritise to transfer the risk with the highest probability and impact. Therefore, medical card is the first insurance you should get.

However, if you are below the age of 40, the immediate next insurance you should get is the Personal Accident Insurance.

Why buy Personal Accident Insurance?

1. High Chance of claim

Why 40?

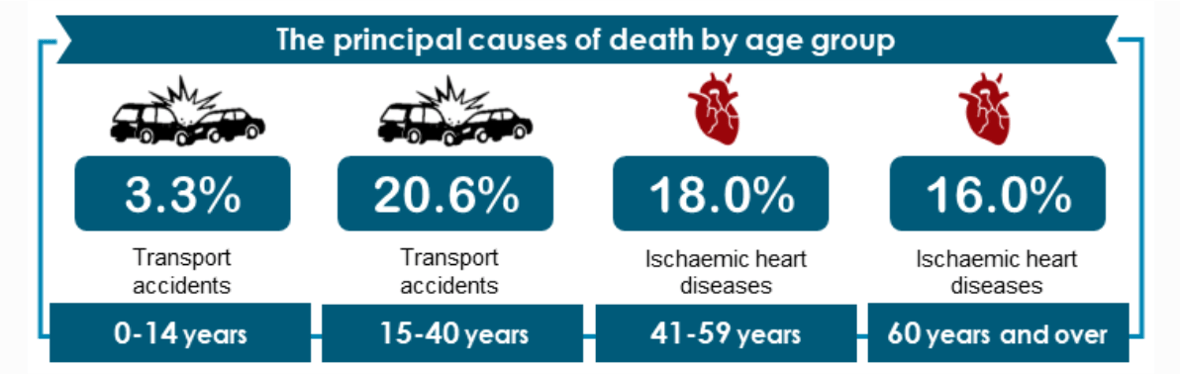

According to the Department of Statistics Malaysia (DOSM), transport accident is the top cause of death for Malaysians below the age of 40.

Since the chance of dying (*touchwood*) from a transport accident is the highest if you are below the age of 40, it makes a lot of sense to prioritise this insurance.

2. Relatively Lower Premium (Cost vs Benefit)

To get a normal life insurance that covers death and disability, it cost a lot more than a personal accident insurance.

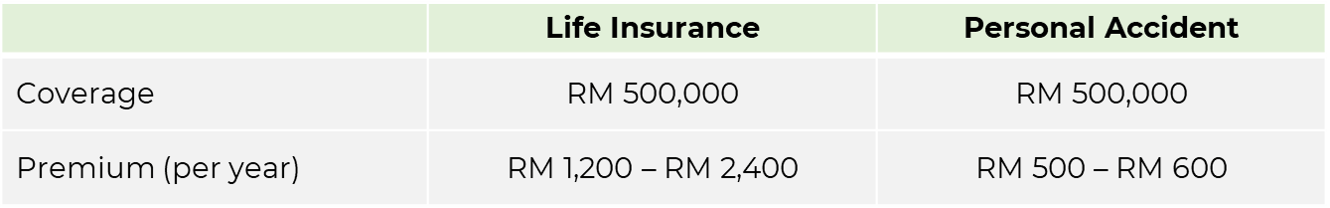

For instance, a normal life insurance with a basic sum assured of RM500,000 will cost someone in his 30s between RM1,200 to RM2,400 per year.

However, a personal accident plan that covers RM500,000 will only cost the same person RM500-RM600 per year.

Don’t get me wrong, life insurance is still very important as an income protection tool (stay tuned to my next article), however, most of us have limited resources (money).

There are many types of insurance that cover anything under the sun, from your pets to electronical devices. But, like all things, we should prioritize which insurance comes first. With the cost of a personal accident plan being relatively low, this makes a lot of sense to get this first if you are below 40.

Tip: A personal accident insurance, coupled with a standalone medical card, makes a great “starter” insurance package. For someone below the age of 30, you can get a decent protection for less than RM1,500 a year.

3. Able to Claim for Partial Disability

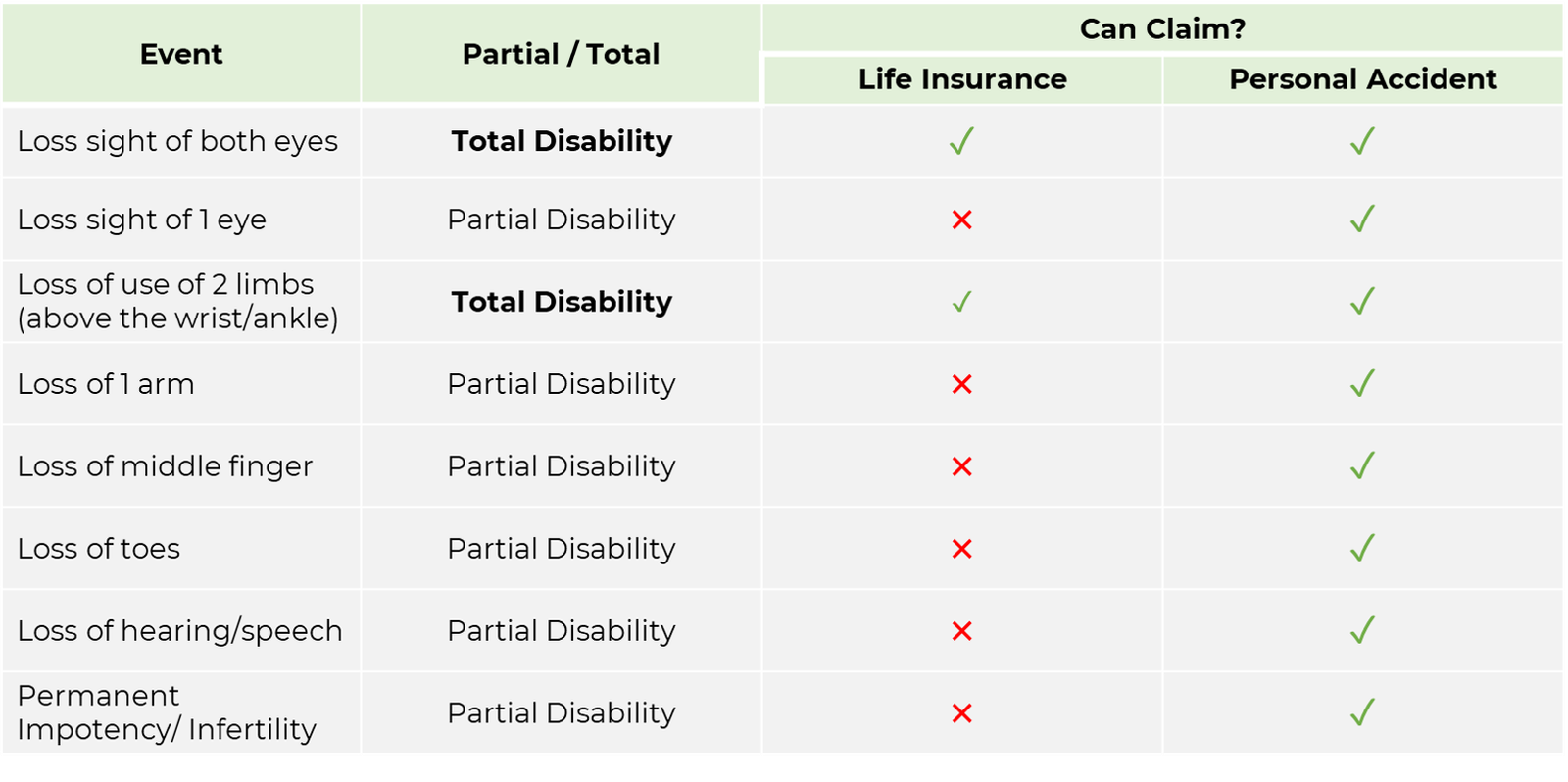

Again, comparing personal accident insurance to life insurance: Personal Accident insurance covers both total and partial disability whereas life insurance only covers total disability.

Yes, these are some technical jargon in your insurance policies. Let me explain the difference with the examples below:

We may still be able to work and earn an income if we lose 1 arm (again, *touchwood*), however, it may take some time to grief and getting used to.

The medical card only covers the hospital bill, not your living expenses, and you can’t claim from your life insurance. Therefore, Personal Accident Insurance is the best tool to complement the gap in your insurance portfolio.

How to Choose a Personal Accident Insurance?

Personal accident insurance is relatively simple, here’s a step by step guide to help you choose your first personal accident insurance:

Step 1: Determine the amount to be covered

To determine the amount to be covered, multiply your annual income by 5. The logic behind this is to cover 5 years of your living expenses plus other miscellaneous costs after the unfortunate event.

Step 2: Choosing Optional Benefits

In a personal accident plan, you can choose to purchase additional benefits. However, the most commonly seen benefit is the Weekly Benefit Option.

Upon the purchase of the Weekly Benefit Option, the insurance company will pay you a weekly allowance if you are not able to work as certified by a doctor.

This is very useful for gig workers and sales personnel as they may not be able to earn an income temporarily.

Step 3: Look for Automatic Renewal

Some Personal Accident Insurance does not have automatic renewal. This is important as we do not want to find our policy has lapsed because we forgot to pay the premium.

What is the limitation of the Personal Accident Insurance?

So far, I have been overselling the benefits of the Personal Accident Insurance. If a personal accident insurance is that good, so, what is the point of getting life insurance then?

As the name suggests, personal ACCIDENT insurance only covers, well, accidents. This means the insurance company will only pay the claims if an accident occurs.

But if the reason for death or disability is due to some other reasons, you will need to rely on life insurance.

However, as mentioned above, due to its low cost and the ability to claim for partial disability is something everyone should look into.

Final Thoughts

After reviewing more than thousands of insurance policies, I dare say that most people do not have a personal accident insurance.

Personal accident insurance is under the General Insurance umbrella, your life insurance agent probably does not focus on this insurance. However, this doesn’t mean you shouldn’t ignore this.

As mentioned above, having a standalone medical card and a personal accident insurance provides you a huge coverage without having to pay a huge premium. This is the best insurance combination for fresh graduates in my opinion.

In the next article, I will explain the importance of life insurance. Life insurance is a huge topic and may potentially cost you a lot of money if not properly planned. So be sure to stay tuned to my Facebook, Instagram, or LinkedIn profile to get the latest updates.

![[Side Hustle] Hustling For a Bigger Investment Capital](https://plannerd.io/wp-content/uploads/2022/08/Cover.jpg)